|

|

#1 |

|

Участник

|

dynamicsax-fico: Parallel accounting according to the “Cost of Sales” and “Nature of Expense” accounting method (2)

Источник: https://dynamicsax-fico.com/2016/06/...ting-method-2/

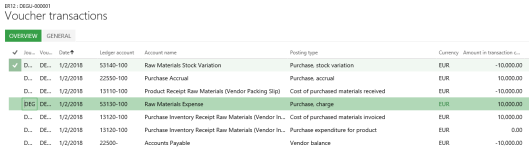

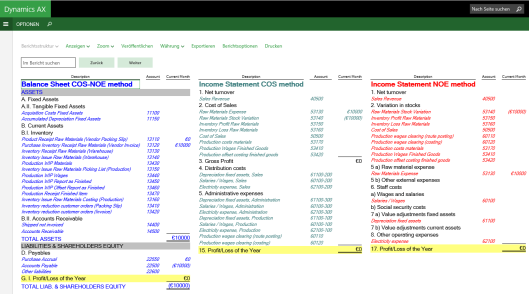

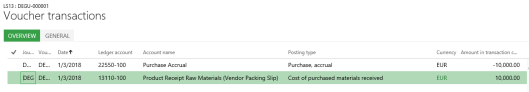

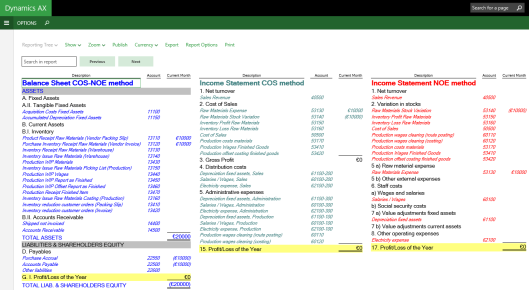

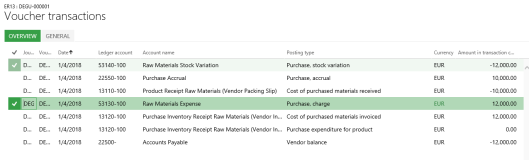

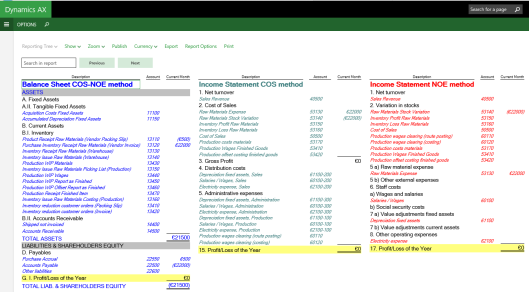

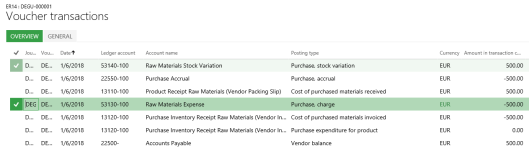

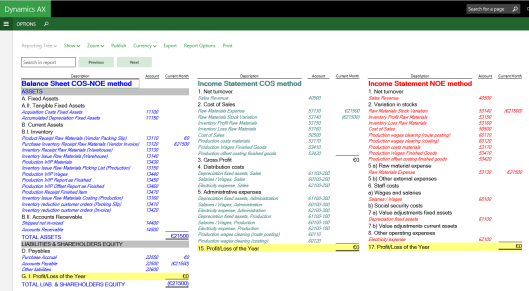

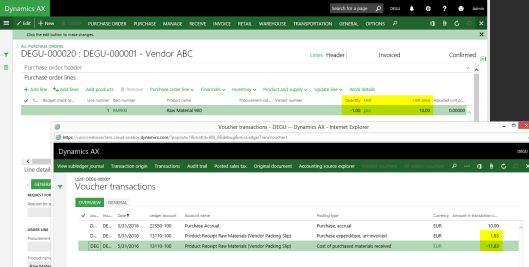

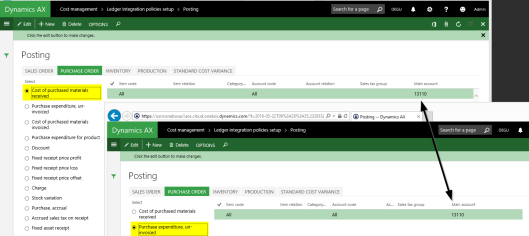

============== Posting 01 January: Packing slip raw material 1 The packing slip transaction for the purchase of the first raw material results in the following voucher.  This voucher debits a product receipt account for the purchased material (account no. 13110) and credits the purchase accrual account (no. 22550). As both accounts are Balance Sheet accounts, no effect on the company’s Income Statement can be identified. The following illustration summarizes the company’s Balance Sheet and its Income Statements according to the COS and NOE method and demonstrates that the packing slip transaction does not affect the company’s profit. Outcome – after packing slip posting  Posting 02 January: Vendor invoice raw material 1 The next step in the purchase process is related to recording the vendor invoice. The invoice voucher created does first reverse the previous packing slip transactions. At the same time a stock increase (on account no. 13120) and an increase in vendor liabilities (on account no. 22500) is recorded. Because of the automatic charge code that has been setup, an additional transaction equivalent to the item purchase amount is recorded on the raw material expense and stock variation accounts no. 53130 and 53140. The next two screen-prints summarize the voucher created and show its influence on the company’s financial statements according to the different accounting methods.  Outcome – after invoice posting  Note: As the raw material expense and stock variation account are both assigned to the cost of sales section of the company’s Income Statement that follows the COS method, no effect on the company’s profitability, KPI’s, etc. results. Posting 03 January: Packing slip raw material 2 The voucher generated with the packing slip posting for the second raw materials purchase is identical to the one created for the first raw material. For that reason, everything that has been mentioned before for the first raw material purchase also applies here. The next screen-prints detail the resulting packing slip voucher and financial statements.  Outcome – after packing slip posting  Posting 04 January: Vendor invoice raw material 2 As also the invoice voucher for the second raw material debits and credits the same ledger accounts that have been used when the posting the vendor invoice for the first raw material, reference can be made to what has been mentioned above. The only major difference between the first and second raw material purchase is reflected in the invoice voucher. That is, for the purchase of the second raw material the slightly higher purchase price of 12 EUR / pcs. results in a stock increase of 12000 EUR that is recorded on the respective ledger account no. 13120. In line with this stock increase, an equivalent transaction on the raw material expense and stock variation accounts can be identified. For details, please see the postings on accounts no. 53130 and 53140 and the resulting financial statements shown next.  Outcome – after invoice posting  Posting 05 January: Packing slip vendor return raw material 1 The return of the first raw materials that did not pass our quality tests results in vouchers that are – except for the sign – identical to the one’s recorded before. For that reason, reference is made to the previous explanations.  Outcome – after packing slip posting  Posting 06 January: Vendor invoice vendor return raw material 1 What has been mentioned for the packing slip voucher generated also applies for the credit note “invoice” voucher. In this respect I would especially like to draw your attention on the parallel raw material and stock variation posting created for the vendor credit note shown in the following screen-print.  The overall result from all of the transactions recorded within this subsection can be identified in the next screen-print that summarizes the effects of the postings on the company’s financial statements according to the COS and NOE accounting method. Outcome – after invoice posting  Note: Dynamics AX uses the so-called running average cost price when issuing goods. With the recording of the vendor return transaction such an issuance occurs. As the running average cost price cannot directly be influenced by users and regularly differs from the price that our vendor credits for the item return, a temporary difference between the stock and stock variation accounts might result. In the long-term this (temporary) variance will be offset through the transactions recorded when closing the company’s inventory. However, in the short-term an additional transaction on the “purchase expenditure, un-invoiced” resp. “purchase expenditure for product” accounts might occur. The next screen-prints exemplify such a situation, where the amount credited by the vendor (10 EUR) differs from the running average cost price (11,83 EUR).   To ensure an always consistent and correct illustration of the company’s Income Statement according to the COS and NOE method it is thus recommendable to setup…

Intermediate result The following illustration summarizes all ledger postings created within this subsection.  Notes:

Based on the transaction summary shown in the previous illustration it can be concluded that the COS and NOE accounting methods can be applied in parallel in standard Dynamics AX. In this respect is has been shown that the shortcoming of the standard AP parameter “post to charge account in ledger” can be overcome by using an automatic charge code. To be continued in part (3) Filed under: Accounts Payable, Accounts Receivable, Fixed Assets, General Ledger, Inventory Tagged: Cost of Sales Method, Nature of Expense Method, Posting setup, Profit & Loss Statement Источник: https://dynamicsax-fico.com/2016/06/...ting-method-2/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

| Опции темы | Поиск в этой теме |

| Опции просмотра | |

|